The Greatest Guide To Lamina Loans

Unknown Facts About Lamina Loans

Table of ContentsNot known Facts About Lamina LoansUnknown Facts About Lamina LoansLamina Loans for DummiesOur Lamina Loans StatementsMore About Lamina LoansExcitement About Lamina LoansLittle Known Questions About Lamina Loans.

Working to improve your credit rating is an excellent step to take previously using for a personal loan. True, also if your credit score health is low, there are subprime lending institutions around who can give you the personal car loan you require. As we said, your interest rate can end up being extremely high, costing you hundreds, even thousands of dollars extra.

If you're searching for a low-interest personal loan in Canada, there are a few things you can do to obtain one. Lending interest finances can be obtained by doing one or more of the following: As previously stated, collateral decreases the lenders' financing danger. Thus, they are extra ready to give a low-interest loan when you supply a possession as collateral.

Not known Details About Lamina Loans

Like security, this supplies your lender with extra protection. You can obtain a low-interest car loan in Canada, if you get a cosigner for your loan. Your credit report can greatly affect the rate of interest price you jump on your funding. The greater your credit report, the much more most likely you'll receive a low-interest car loan in Canada.

It's called a "guarantor finance" and also entails finding a cosigner prior to applying. Your very own negative credit score will no more be an issue during the application procedure. Rather, your authorization will pivot on your cosigner's credit scores health and wellness. Ideally, your cosigner would need to have good credit report as well as a respectable earnings - Lamina Loans.

Yes, there are many alternative lenders in Canada who supply personal lendings with no credit report checks. In location of your credit history, they will certainly evaluate your revenue level, employment security, debt-to-income ratio and also various other monetary elements that will certainly identify your creditworthiness. When using for an individual funding you'll have to give specific documents for confirmation as well as identification objectives.

All about Lamina Loans

The price you're billed depends on your lender, your debt score, your debt-to-income proportion, and also even your funding terms. On standard, passion prices differ anywhere in between 15% and also 45% for an individual loan.

Click the button below to fill in an application to see what your options are.

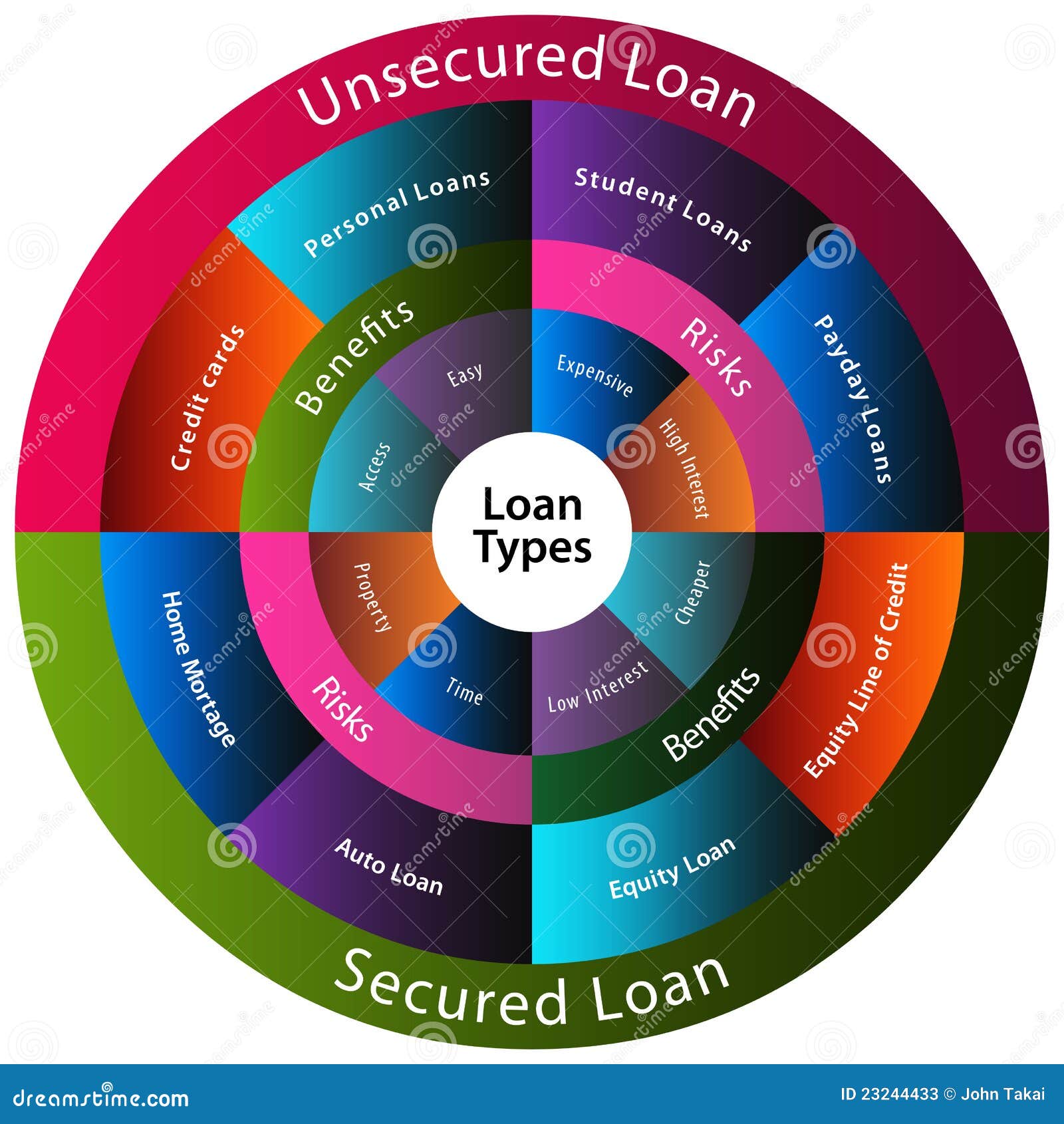

To help you determine, right here are the benefits and drawbacks of all the various kinds of fundings: A lot of individual finances as well as small business car loans are unprotected fundings. Unprotected means that you're borrowing cash without placing anything up as security to "protect" the funding. These finances normally need a higher credit report to prove your creditworthiness.

Excitement About Lamina Loans

Some lending institutions may also allow you to establish a reasonable settlement amount based on your revenue as well as interest rate. Contrast individual financing lenders prior to you make a decision, so you can discover the appropriate terms for your situation. You can commonly get a personal funding for whatever you require it for like home enhancement or financial obligation combination.

The lower your rating, the much less likely you are to certify and also if you do, the greater your interest price will certainly be. You'll need to show you can pay for to pay the loan back. If you don't have a constant job with a trusted income, you may not get authorized for a loan.

Things about Lamina Loans

It's ideal for any individual with an excellent credit history who can show they'll pay it back on a monthly basis. Safe personal lendings are car loans that need collateral like your home or vehicle to "secure" or obtain the loan. If you default on your loan, the lending institution can confiscate the residential or commercial property you put up as collateral.

Due to the fact that you're utilizing something as collateral, secured fundings are simpler to take out for individuals with lower credit ratings. Because there's collateral, the lending institution views you as a much less high-risk debtor, so rates of interest have a tendency to be lower on guaranteed financings If you do not make on-time repayments, your security can get taken away.

A guaranteed financing is terrific for a person who does not have a perfect credit history for a car loan yet requires one anyway. If you do not have a high credit rating, think about a protected loan to show you Clicking Here can pay on schedule each month. A revolving credit line gives you accessibility to cash click this link that you can obtain up to your credit report limit.

The Ultimate Guide To Lamina Loans

, or a house equity line of credit report (HELOC). If you've got costs that are due, however don't obtain paid for a few weeks, rotating debt can assist you pay those bills.

Many credit scores cards supply incentives for use, like cash money back, points, or other benefits. This quantity can fluctuate based on exactly how you utilize your rotating credit history.

This is the opposite of rotating debt, where you can take money out as well as pay it back over the course of a few months or years, depending on your agreement.

Lamina Loans Fundamentals Explained

If your installation car loan has a fixed rate of interest, your lending repayment will certainly be the exact same each month. Your spending plan won't fluctuate based on your settlements, which is helpful if you don't have a great deal of shake space for change. Installation loans do not allow you to return as well as obtain extra in instance you need it.

Or else, you may require to get another car loan. Having a set amount you require to borrow and also pay back makes installment car loans ideal for someone who knows specifically just how a lot they require as well as just how much they can manage. A set rates of interest is a Click This Link rate that doesn't transform over the life of the lending.